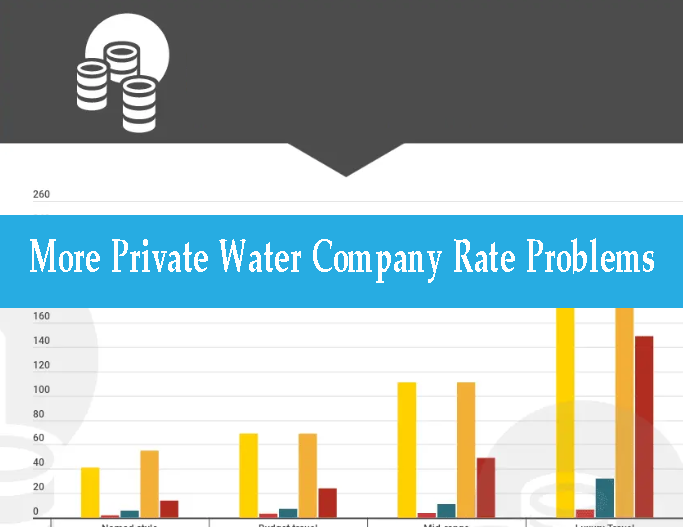

Privatization is thought by many to be a panacea for lowering costs for water and wastewater systems. Yet, here we have again another example of how a private owner/operator, in this case Indiana American (subsidiary of American Water, NYSE: AWK), seeking a very large increase in rates (click here for the news story). We have reported on this same issue a couple of times already in just the past few months. In “Corporate Water Rates – Show Me the Efficiencies” we cited a case involving Illinois American (also a subsidiary of American Water); and in “Private Does Not Mean Better Water Rates” we discussed the huge increase proposed by Veolia (NYSE: VE) as the private owner/operator of the water works in Indianapolis, IN.

The predominate cost of owning and operating a water or sewer utility is the cost of capital. Municipal entities have access to low-cost and tax-exempt debt, private operators may or may not have such access. Private owners can issue stock to raise capital, which could be an advantage except those stockholders expect a return on their money that is higher than the interest rate paid on debt, and the private utility gets to include those returns in the rate you pay (they have a constitutional right to do it). In order for a private operator to produce lower rates in the long-run, they would have to drive operating costs down significantly. They would have to generate about 20% savings just to account for the additional cost of income taxes that private owners have to pay (your municipal system does not pay taxes), and then they would have to save even more to account for profits paid to shareholders.

A perfectly good question to ask if your community is looking to privatize is whether the private owner/operator really can lower your bills and sustain those savings over time. We are seeing evidence right now that private owners are not able to perform any better than public owners, and the cost savings do not appear to be sustainable either.

Be Sociable, Share!